utah restaurant food tax rate

The rolls are grocery food taxed at the lower rate plus tourism restaurant tax. Both food and food ingredients will be taxed at a reduced rate of 175.

Sales Taxes In The United States Wikipedia

Theres a 485 tax on prepared foods like what you get in a restaurant.

. We would like to show you a description here. Counties may adopt this tax to support tourism recreation cultural convention or airport. Restaurants must also collect a 1 percent restaurant tax on all food and beverage sales.

Utah specifies that prepared food is considered ready to eat or sold with utensils. To find out what the rate is in your. Both food and food ingredients will be taxed at a reduced rate of 175.

Utah has state sales tax of 485and allows local governments to collect a local option sales tax of up to 335. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Utah Restaurant Tax.

Theres a 175 tax on unprepared foods like what you would. All Utah sales and use tax returns and other sales-related tax returns must be filed. However in a bundled transaction which involves.

How much is restaurant tax in Utah. Food versus Non-Food Matrix. Depending on which county the business is located in the restaurant tax in Utah can range from 610 to 1005.

Exact tax amount may vary for different items. The restaurant tax applies to all food sales both prepared food and grocery food. The state provides a guidance page with plenty of examples on what is and what is not.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. There are a total of 125 local tax jurisdictions across the. 675 Is this data incorrect The Kaysville Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Kaysville local sales taxesThe local sales tax consists.

93 rows This page lists the various sales use tax rates effective throughout Utah. There are a total of 131 local tax. 2022 Utah state sales tax.

Report and pay this tax using form TC-62F Restaurant Tax Return. Restaurants must also collect a 1 percent restaurant tax on all food and beverage sales. TAXABLE In the state of Utah the foods are subject to local taxes.

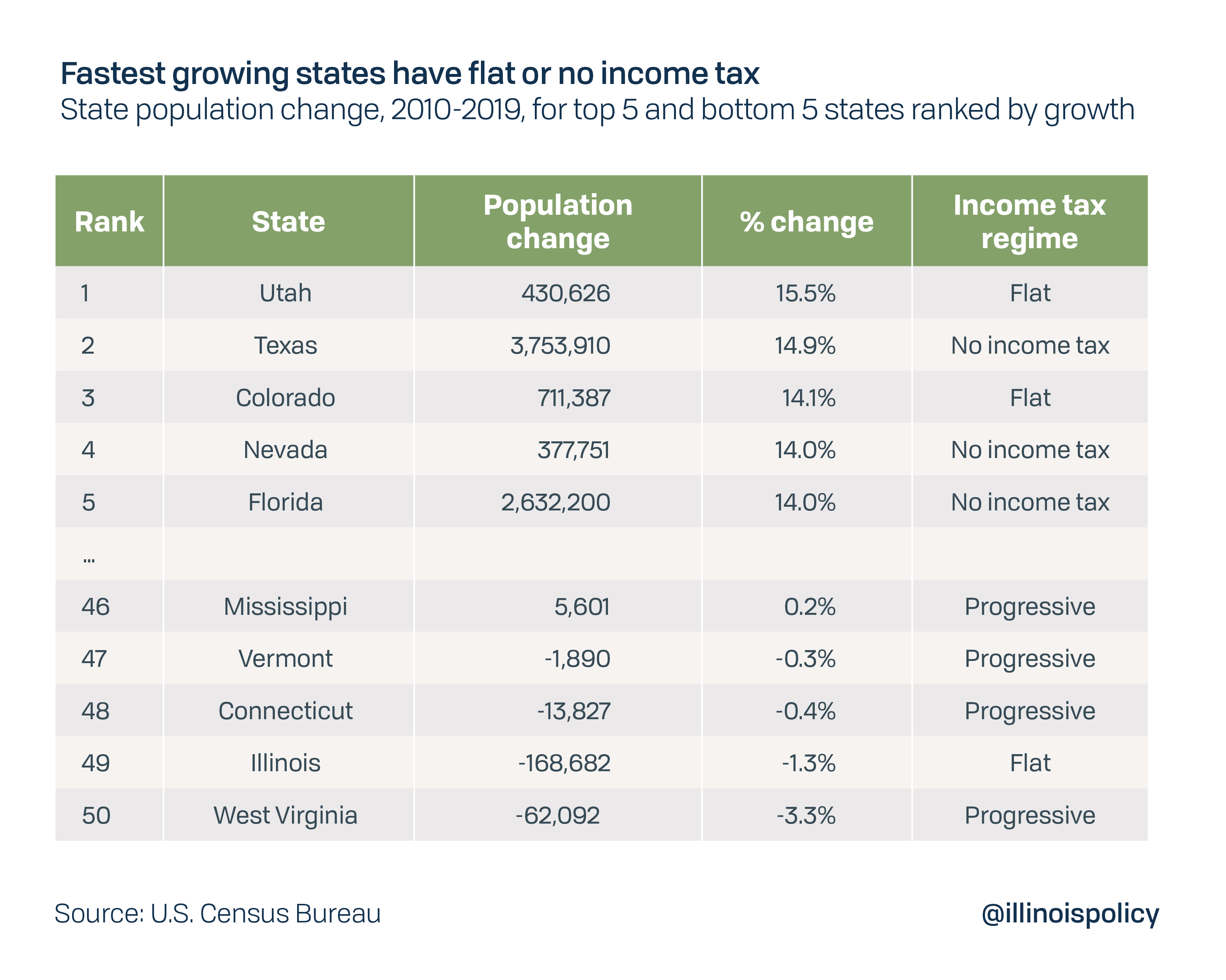

Every State With A Progressive Tax Also Taxes Retirement Income

How Do State And Local Sales Taxes Work Tax Policy Center

![]()

Everything You Need To Know About Restaurant Taxes

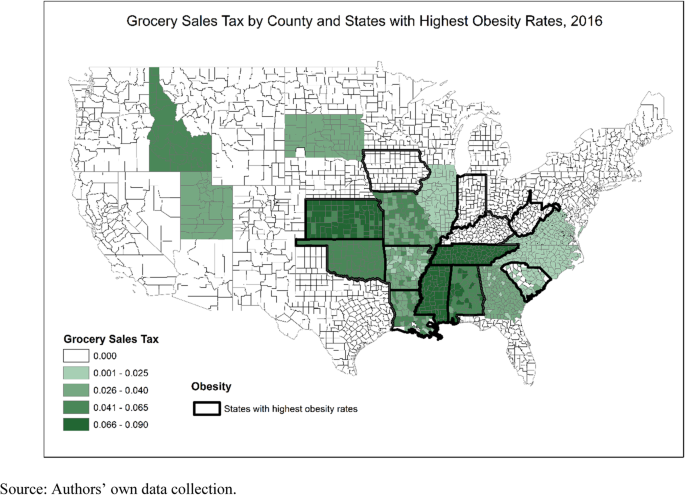

Grocery Food Taxes And U S County Obesity And Diabetes Rates Health Economics Review Full Text

Why Utah Restaurants Close From Food To Finances To Family

Grocery Prices Inflation And Food Taxes Don T Mess With Taxes

Utah Sales Tax Small Business Guide Truic

Utah Sales Tax Calculator And Local Rates 2021 Wise

How To Charge Your Customers The Correct Sales Tax Rates

Food Delivery Apps Deliver Sales Tax Complexity

General Sales Taxes And Gross Receipts Taxes Urban Institute

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com

Everything You Need To Know About Restaurant Taxes

Decried As Unfair Taxes On Groceries Persist In Some States The Pew Charitable Trusts

Everything You Need To Know About Restaurant Taxes Eagleowl Restaurant Management And Analytics Software

Illinois Sales Tax Audit Basics For Restaurants Bars

States Try To Raise Some Dough By Taxing Uncooked Pizza To Go