tax strategies for high income earners australia

Family Income Splitting and Family Trusts. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Advanced Tax Strategies For High Income Earners In Australia Solve Accounting

Qualified charitable distributions qcd 4.

. That is why we suggest that you read our Ultimate Guide for the best tips to find the right financial advisor for you. For high-income earners this would lead to a significant tax reduction. Division 293 tax is an extra.

6 Tax Strategies for High Net Worth Individuals. If you are a mid to high earner in Australia this income tax change may be the answer you are looking fo. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead.

How Much Does A High Income Earner Earn In Australia. Tax strategies for high income earners australia Thursday February 24 2022 Edit. A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT.

Both are studying and will continue education for another 5. How to Reduce Taxable Income. Implementing tax minimisation strategies is crucial for high-income earners.

However this is not the full story. The ability to invest in a roth 401k and then withdraw all. The ability to invest in a roth 401k and then withdraw all.

By Wealth Planning Team Jun. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. Using a Discretionary Trust to reduce taxes.

This is one of. Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income. Tax strategies for high income earners.

Qualified charitable distributions qcd 4. Mon - Fri. Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI.

Qualified Charitable Distributions QCD 4. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. For single filers if your 2021 taxable income was 40400 or.

This is a tax-effective strategy because super contributions. However while there are no limits to the amount of salary you can sacrifice unless specified in your terms of. This article lists seven strategies you should consider.

Wish there was a little extra money in your pocket. Tax Reduction Strategies For High Income Earners Australia. In this article well look at the most common types of tax strategies for high-income earners and how you can make the most use of them.

Use Roth Conversions Wisely and Regularly. Tax Planning Strategies for High-income Earners. 1441 Broadway 3rd Floor New York NY 10018.

If you are over age 50 you can contribute an additional 6500 per year in catch-up contributions meaning you can defer a. Jane earns 230000 salary per year and has 2 adult children of 19 and 18. For 2022 the maximum employee deferral to 401k is 20500.

How Do High Income Earners Reduce Taxes In Australia

Tax Reduction Strategies For High Income Earners 2022

Tax Strategies For High Income Earners 2022 Youtube

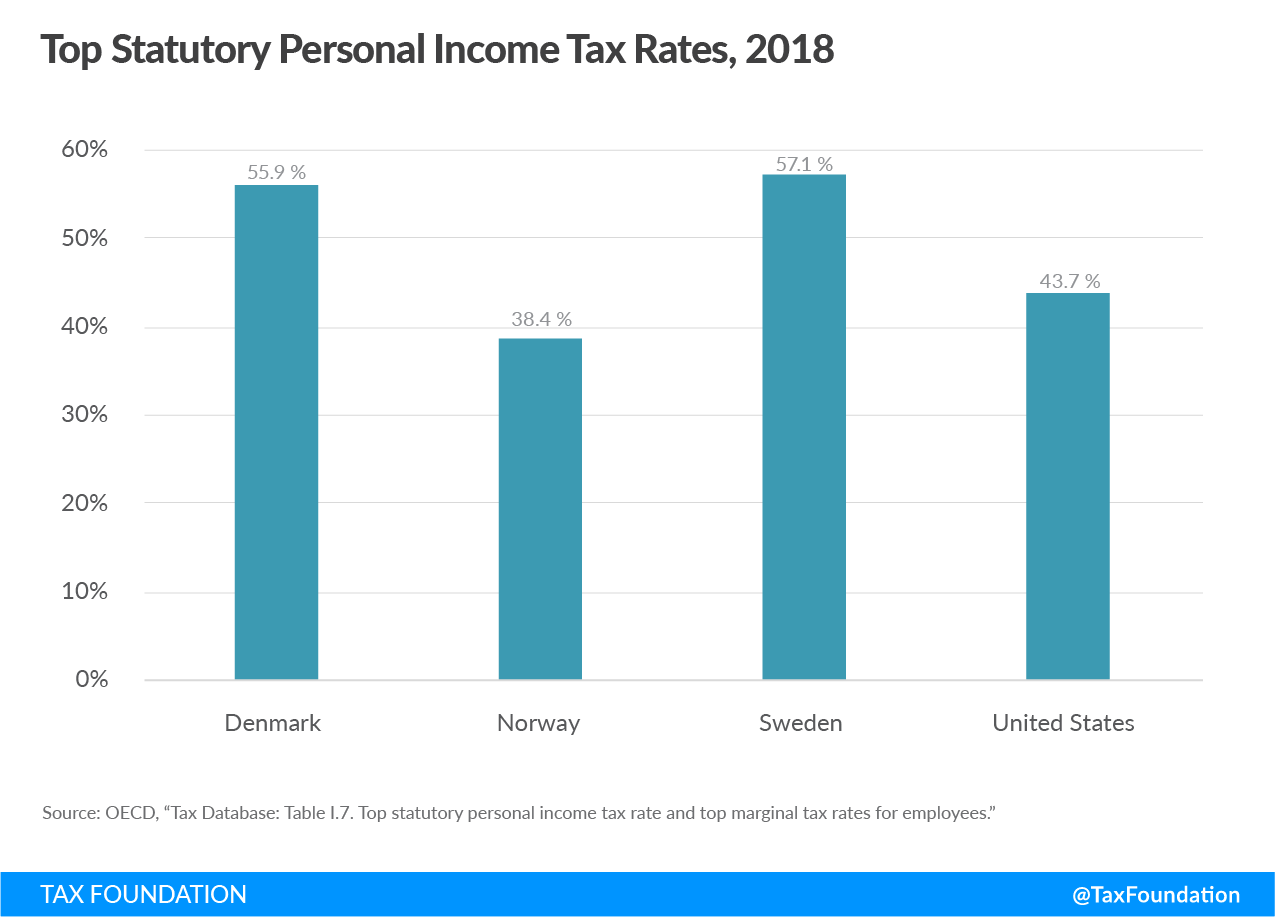

How Scandinavian Countries Pay For Their Government Spending

How Can 7 Figure Income Earners Save On Income Taxes Quora

Resources Craig Allen And Associates

Proposed Tax Changes For High Income Individuals Ey Us

Tax Reduction Strategies For High Income Earners 2022

Calling All Retiring Types Make Sure Your Superannuation Fund Stays Super South China Morning Post

How To Pay Less Taxes For High Income Earners Wealth Safe

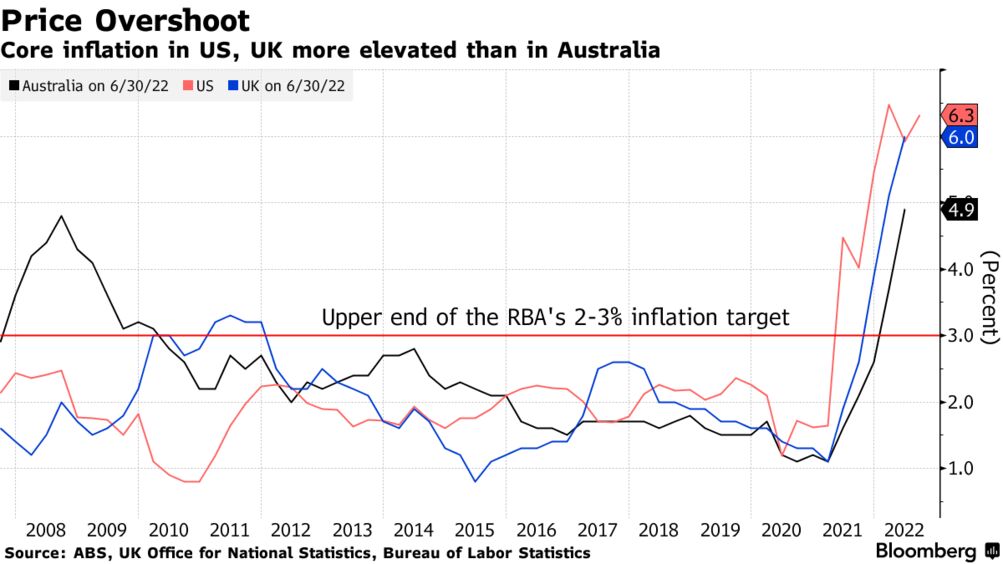

Australia Under Pressure To Revise Tax Cuts Following Uk Chaos Bloomberg

U S Income Tax Policy Is Mostly About The 1 Bloomberg

How Scandinavian Countries Pay For Their Government Spending

Tax Reduction Strategies For High Income Individuals In 2021 Youtube

What Salary In Australia Puts You In The Top 10 The Top 5 The Top 2 And The Top 1 Percent In Terms Of Salary Quora

Tax Reduction Strategies For High Income Individuals In 2021 Youtube